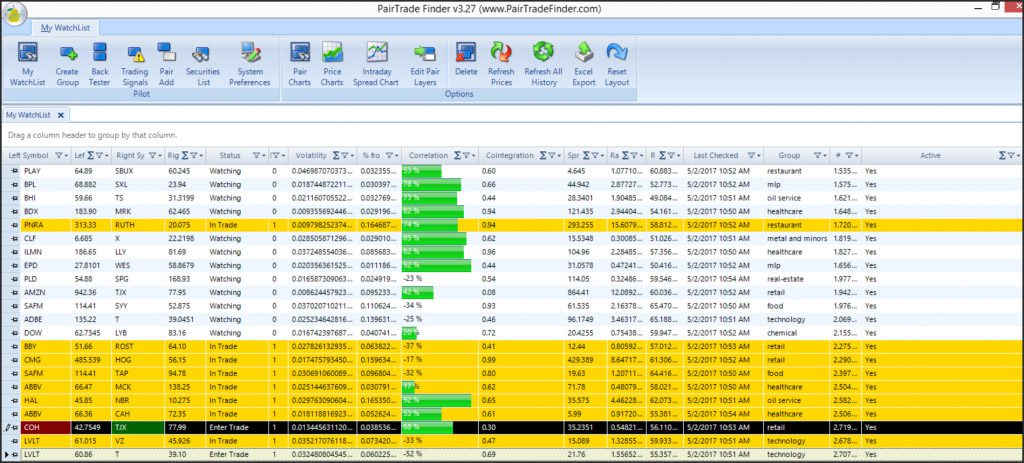

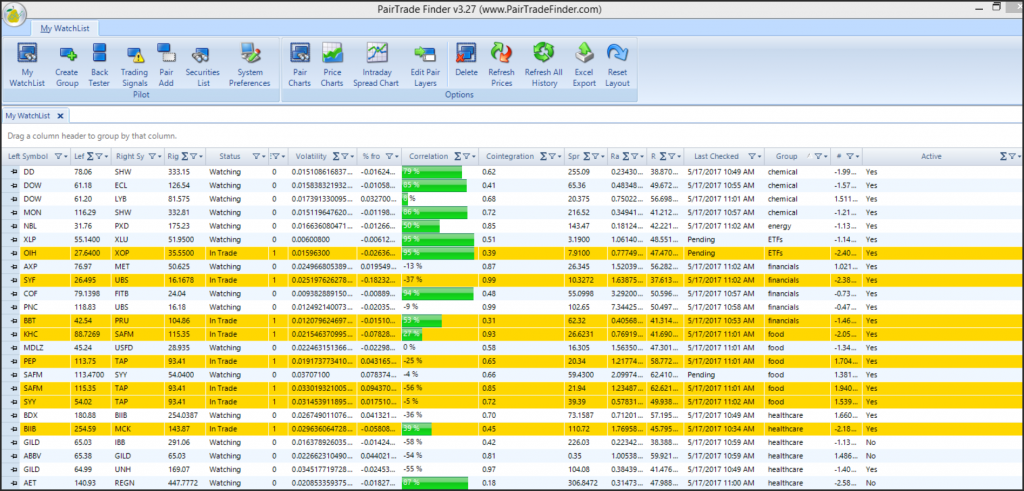

Your watch list will act as your home screen where you can evaluate pairs that have back tested through the Pair Trade Finder system. After you have gone through the process of finding pairs to evaluate, back testing them, and adding them to the system, your pairs will be viewable on your watch list. There are a few important issues you should consider when developing a portfolio of stock pairs to watch, which include the number of specific industry pairs you should monitor, single stock concentration and how to anticipate a signal.

After you have gone through the process of finding companies that are in similar industries, you can add them to the Pair Trade Finder system, with a description as you are adding them to a group. This description will help you monitor these stock pairs when you are evaluating your watch list. You might considered labeling them with sector names, such as financials, or energy.

You goal is to add approximately 5-8 pairs, that you monitor in your watch list. You want to find the pair that are most attractive to you through the back testing process. You can use criteria such as winning percentage or most profitable or even choose trades with the highest correlation or co-integration. You want to avoid having too many pairs in the same industry as this might alter your long term performance. By having a heavy concentration of pairs in one industry a specific event might generate many signals that all move in tandem, and generate unwanted losses.

Additionally, you also want to avoid signal stock risk. By having multiple pairs with the same stock, you could create signal stock risk where multiple signals are generated at the same time because a stock experienced negative headline news or even positive market information. For example, if you had 4-pairs were Banks of America is paired versus, Citigroup, Morgan Stanley, J.P. Morgan Chase and Wells Fargo, and Bank of America has worse than expected earnings results, you will get 4-signals, and may experience 4-losing trades.

You can sort your watch list by group and see how many pairs you have per sector and reduce this number by the criteria that you deem the most important.

Lastly, each headline in your watch list provides you with the capability to sort using that title. By sorting with the deviations from mean title, you can monitor the level and anticipate a change above or below your signal. If your signal is 2.7 standard deviations above the 100-day moving average, then as a pair climbs toward that level you can begin to monitor that pair and determine if you are interested in that trade if a signal is generated.

Contact us to start your 30-day free trial of Pairtrade Finder software, the perfect software tool designed to help you easily and quickly find high probability securities pairs to trade.