Autohome Inc. (NYSE:ATHM) vs. Twitter, Inc. (NYSE:TWTR)

38% Return in 8 Market Days!

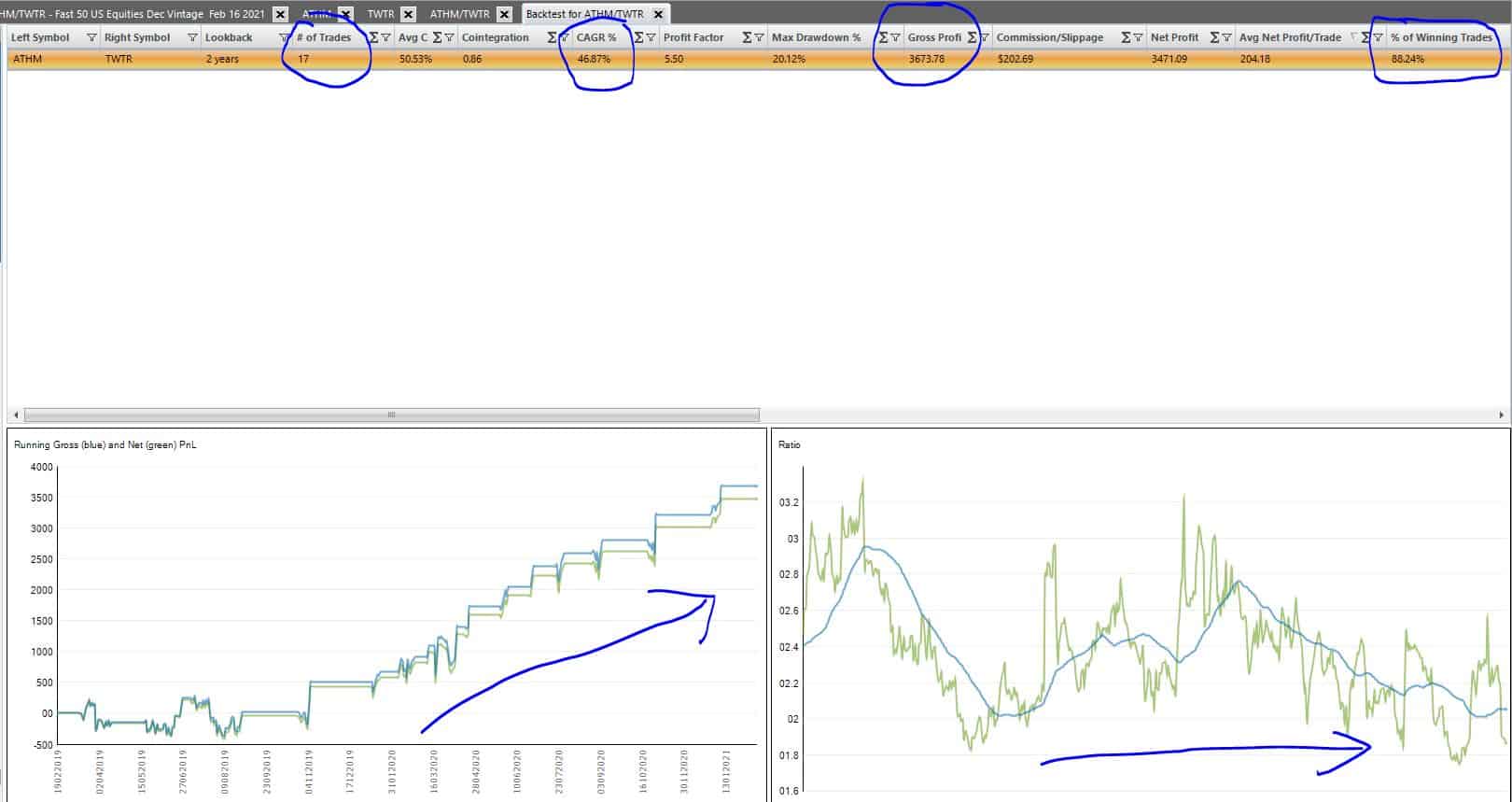

Backtest Results:

In backtesting over the two years prior to 5 January 2021, cointegrated and correlated stock pair ATHM/TWTR delivered 17 closed trades, an 88% win rate, a 47% CAGR(!!!), an average net profit per trade of $204, and over $3,674 in total profits, all based on only $3,000/leg position size:

Actual Stock Pair Trade Result

In actual trading, ATHM/TWTR called an Entry Signal EOD on 28 December 2020 at a -2.57sd. The trade exited on 8 January 2021, eight days later at a +0.27sd, delivering a $456 Net Profit and a 38% return on margin! (assumes $3,000/leg trade size and 5:1 CFD margin, illustrative):

PairTrade Finder®’s FAST 50 U.S. Equities Pairs & Example Stock Pair Trade Signals

We analyse over 1,800 U.S. equities to find you the best stock pair trades! We update this analysis on a quarterly basis to ensure these pairs stay fresh and their correlations and cointegrations strong to offer you the highest-probability setups. The new FAST 50 are based on shorter-term and more aggressive parameters. All pairs must meet strict profitability and robustness measures as follows:

- USA Exchange-traded (NYSE/NASDAQ/AMEX): > than $2 bln mkt cap (most much larger), > $2 million/day of average daily traded volume($), easy-to-borrow

- Similar fundamentals: same national market, same sector, usually same industry sub group. Preference for beta-similar, market-cap-similar pairs

- Backtested with a +/-2.5 standard deviation Entry Stretch, +/-0.8 standard deviation Exit Stretch on the Core Ratio of the pair’s share prices

- Two-year backtest lookback period, 21-day (one trading quarter) Standard Deviation, Stretch lookback settings, 42-day Ratio Moving Average lookback setting.

- COINTEGRATION: We use the Augmented Dicky Fuller test for co-integration and select only pairs with a p-value of 0.10 or less over the 2-year period

- CORRELATION: of minimum 50%, preferably higher. Lower correlation can be tolerated if pair is strongly cointegrated and scores highly on all other criteria

- Minimum Average Profit per Trade of $300, preferably $400+ (based on $10,000/leg)

- Compound Annual Growth Rate of Net Profits for each pair preferably in excess of Maximum Drawdown % i.e. positive reward/risk

- Maximum historic drawdown < 20%, preferably <15% (before leverage)

- Win Rate at least 70%

- Maximum Days in Trade of 30 days. This setting represents our time stop. Average days per trade is around 8-12 days

Subscribe today and receive immediate stock example pair trade signals straight to your email as they arise.

Happy trading.

Geoff, Paul & The PairTrade Finder® Team

NB: The FAST 50 example pair trades in PairTrade Finder® PRO and the trading signals generated therefrom are provided for informational and educational purposes only. They should not be construed as personalised investment advice. It should not be assumed that trading using the parameters demonstrated by the Software will be profitable and will not result in losses. Please see our full Terms & Disclaimer here.