Looking For the Best Pair Trades?

Amcor plc vs. Berry Global Inc.

$537 in 9 Market Days!

13.4% Return on Margin

(based on $10k/leg size and 5:1 CFD margin)

Watch our stock pair trade analysis from this pair from our July Vintage LAYERED FAST 50 U.S. Equities Pairs:

PairTrade Finder®’s FAST 50 – One Step Closer to Automated Trading of the Best Pair Trades

We analyse over 2,200 U.S. equities to find you the best stock pairs to trade! We update this portfolio of curated stock pairs on a more-or-less quarterly basis to ensure these pairs stay fresh and their correlations and cointegrations strong to offer you the highest-probability setups. These pairs can be used to generate immediate automated pair trading signals for you to analyse and, if you like the setups, trade.

How Do We Find the Best Pair Trades?

First, we use the latest version of our award-winning pair trading platform PairTrade Finder® PRO v2 and we scour the USA stock universe. We invest hundreds of hours to screen, backtest and qualify these LAYERED FAST 50 Pairs.

To be eligible to be included in the LAYERED FAST 50, all component pairs must meet strict profitability and robustness measures as follows:

- USA Exchange-traded (NYSE/NASDAQ/AMEX)

- > than $2 bln mkt cap (most much larger)

- > $2 million/day of average daily traded volume($)

- Easy-to-borrow

- Similar fundamentals: same national market, same sector, usually same industry sub group

- Preference for beta-similar, market-cap-similar pairs

- COINTEGRATION: We use the Augmented Dicky Fuller test for co-integration and select only pairs with a p-value of 0.10 or less over the 2-year period

- CORRELATION: of minimum 50%, preferably higher

- Backtested with a Layer One +/-2.4 standard deviation Entry Stretch, a Layer Two +/-3.0 sd Entry Stretch, and a +/-1.0 standard deviation Exit Stretch on the Core Ratio of the pair’s share prices

- Two-year backtest period

- 63-Day Standard Deviation, Stretch, and Ratio Moving Average lookback settings

- Minimum Average Profit per Trade of $250, preferably $300+ (based on $5,000/leg per layer)

- Compound Annual Growth Rate of Net Profits for each pair preferably in excess of Maximum Drawdown % i.e. positive reward/risk

- Maximum historic drawdown < 20%, preferably <15%

- Win Rate at least 70%, preferably >85% as layers help a lot!

- Maximum Days in Trade of 50 days as a time stop. Average trade duration was 15 days in backtesting

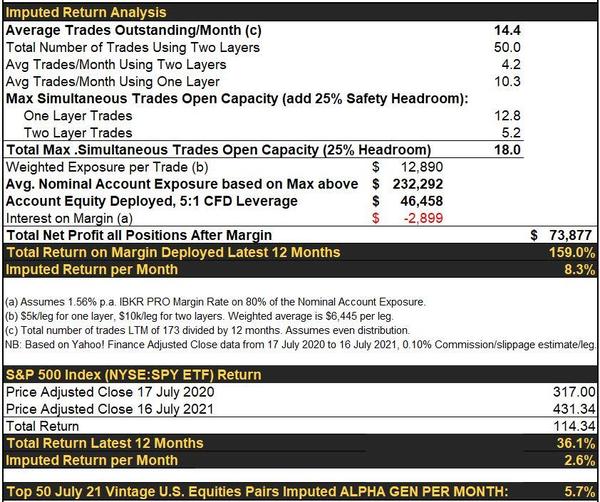

What If You Applied Automated Pair Trading to Their Signals?

How Can I Get Them?

Subscribe today and receive a 15-Day Free Trial of PairTrade Finder® PRO with these LAYERED FAST 50 U.S. Equities Pairs PRELOADED into your Watchlist. PTF PRO will immediately begin generating live trading signals from these pairs for your further review. One step closer to an automated pair trading system!

We also provide you with our eBook with 11 Pro Trading Tips, our 13 Tutorial Videos, and our 3.5-HOUR, 13-LECTURE PAIR TRADING VIDEO TRAINING COURSE taught by professional pair traders.

Happy trading.

Geoff, Paul & The PairTrade Finder® Team

* Pairs trading and selection methods: is cointegration superior? Nicolas Huck and Komivi Afawubo. Applied Economics, 2015, vol. 47, issue 6, 599-613

NB: The LAYERED FAST 50 example pairs in PairTrade Finder® PRO and the trading signals generated therefrom are provided for informational and educational purposes only. They should not be construed as personalised investment advice. It should not be assumed that trading using the parameters demonstrated by the Software will be profitable and will not result in losses. Any performance results of our recommendations prepared by www.pairtradefinder.com are not based on actual trading of securities but are instead based on a hypothetical trading account. Hypothetical performance results have many inherent limitations. Your actual results will vary. Please see our full Terms & Disclaimer here.